The Rules Define the Game & Ethics of Prediction Markets

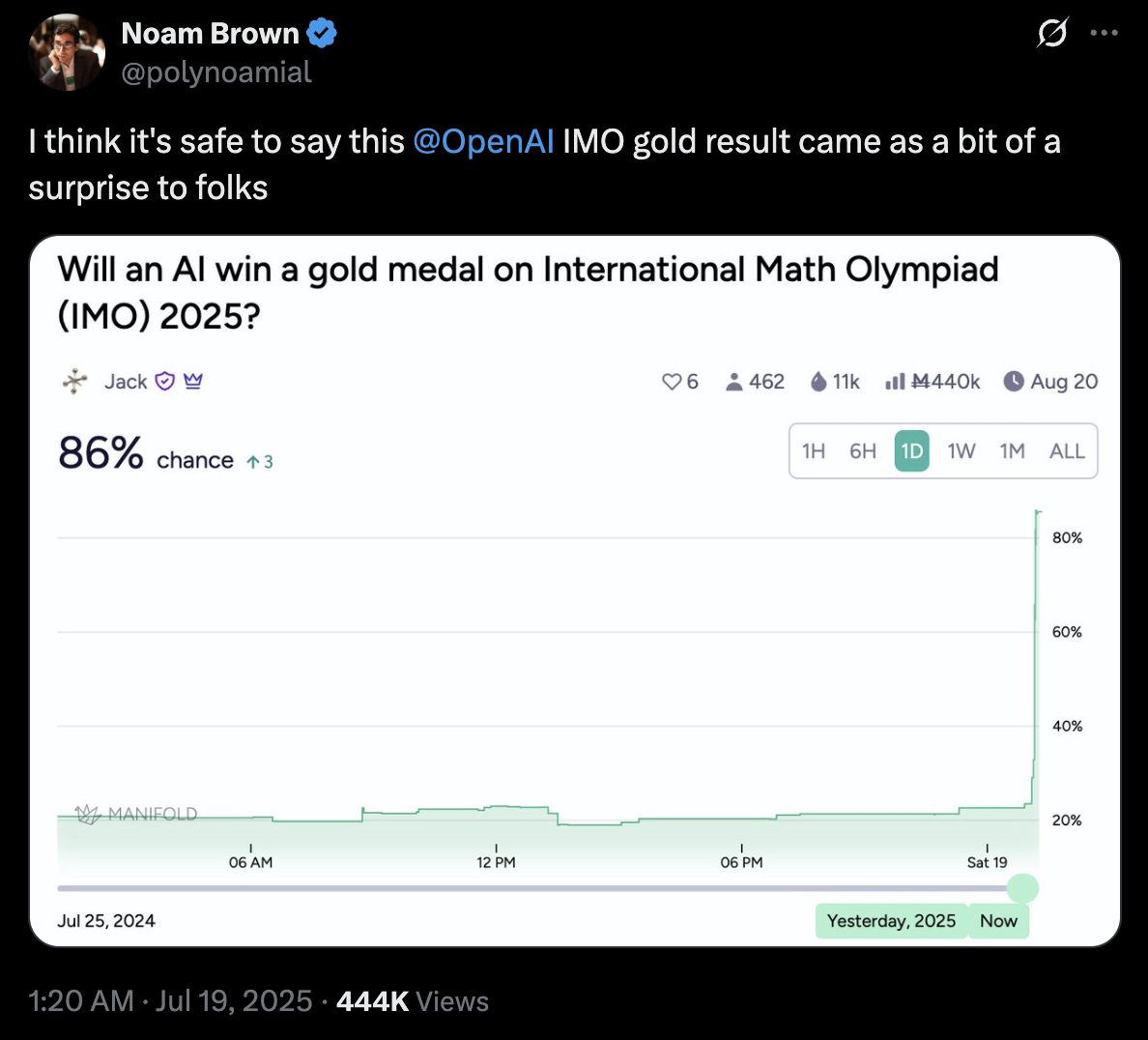

It occurred to me the other day with the OpenAI International Math Olympiad results that OpenAI is either very good at keeping corporate secrets a secret, or they have highly ethical employees, or both (likely)! If this were not true, I would have expected the prediction markets to have reflected the likely performance outcome prior to the actual IMO event, i.e. signifying the leak in the form of opportunistic individuals hoping to make monetary returns. As summarized on X:

This result made me curious about the lack of an official regulatory body overseeing these markets (e.g. SEC) to punish insider trading. In fact, isn’t the point of a prediction market like this to align incentives around discovering the truth over enforcing rules about how information is shared? The accuracy of these prediction markets is in fact improved by alignment on accurate information as a primary principle. I’m sure the folks who follow this domain more closely have covered this topic and I’m late to the game, but it was a passing thought.

And that passing thought brought me full circle to a kind of simple reminder: markets, like any game, are defined by their rules, so you should scrutinize those rules closely. Of course I was aware that stock markets in the US, for example, have rules and regulations, I just never thought of them as defining characteristics as much operational small print1. The US stock market’s rules serve many purposes, but one, at face value, is ensuring fair participation. That’s in stark contrast to a prediction market where the primary principle is accuracy above all else.

-

In a “what if there was an Olympics where doping was permitted” fashion, have you ever asked yourself what the the NYSE would look like if insider trading was legal and promoted? What society would look like? ↩︎